Capital credits separate cooperatives from other electric companies. As not-for-profit organizations, cooperatives return savings to patrons through this program. At each November meeting, the North Central Electric Cooperative Board of Trustees reviews capital credits and may authorize a refund. When authorized, a refund will be extended to current and former eligible members.

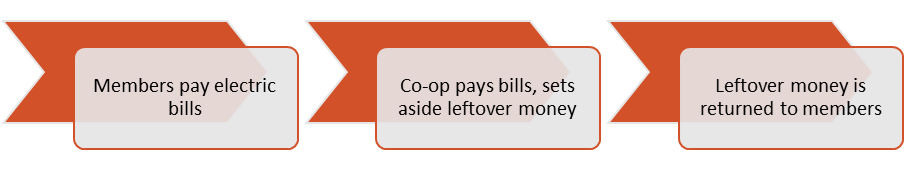

Allocation of money back to the consumer relies on the costs of running and growing the business. The cooperative relies on revenue from bills to cover these expenses and build emergency funds. Money left over at the end of the year is considered part of our margins. Margins are set aside and credited to each member as capital credits based on rate and energy consumption. The longer we’re your service provider, the more you’ll get back over time.

When refunds occur, we return a portion of profits to YOU based on the above factors. The total amount refunded is determined by the Board of Trustees.

Capital credit refunds under $100 appear as a credit on the December bill; refunds of $100 or more, or previous members without an active billing account, will be mailed as a check-in December. This is true most times, but exceptions occur.

Capital credits are a return of profit margins to the consumer. They are not taxable income unless electricity is claimed as a business expense. We can only give refunds after ensuring our financial stability.

Lost refund checks can be replaced after 90 days. Once the check expires, we must verify the check has not been cashed. We will then forward your info to our accounting department for reissue.

A member’s capital credits balance is not a cash value - it is an amount assumed you will receive over time. Capital credit accounts may be transferred, or discounted and paid out, only to estates without a surviving spouse or to inactive members with a total capital credit balance less than $400. To close a late member’s account, a death certificate and Letter of Authority must be received by the co-op. This complies with federal identity theft regulations.

Being a member of the co-op is the reason you receive capital credits while other people who are customers of investor-owned utilities, like AEP (American Electric Power) or FirstEnergy, do not.